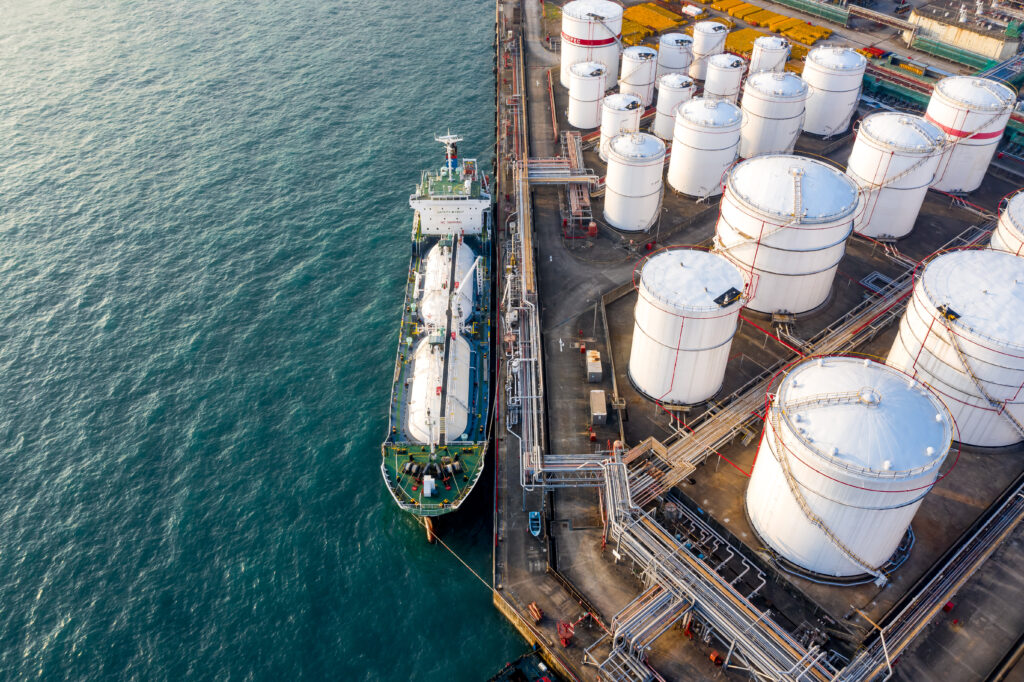

We provide hedging strategies to companies in the Oil & Gas sector

Helping your Oil business thrive with the use of financial derivatives

Who we are

An Agency with more than 20 years of experience

We advise clients on the purchase and sale of petroleum products and agricultural raw materials with more than 20 years of experience in these sectors.

We are focused on wholesale markets for fuels, biofuels and agricultural materials covering the entire chain, from refiners, traders, millers, distributors to service stations or factories.

With decades of experience in european markets, we now bring our experience and know-how to the USA.

We have in-depth knowledge of the derivatives sector (oil futures) as well as the fuel industry., which gives us a broad understanding of the tendencies, clients, suppliers, timings, etc.

What we do

WYDerivatives provides specific advisory technical services to wholesale merchants regarding the Oil business

Our areas of advice include:

- Commercial management and optimization of hydrocarbon logistics and markets.

- Reduction of price and exchange rate risks.

- We offer advice on futures and options on commodities and currencies.

- Guidance on delivery times, market prices and exchange rates.

- Input on commodities sales or replacements.

What we don’t do

This wide scope does not include direct access to markets.

- WYDerivatives is not a broker nor a dealer.

- WYDerivatives is not an executing or clearing operator.

- WYDerivatives is not a general provider of these services, and therefore does not directly handle clients funds.

- WYDerivatives is not a brokerage open platform of financial assets, currencies or derivatives.

WYDerivatives only works with professional clients

Professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs. In order to be considered to be professional client, you must meet two of the following size requirements on a company basis:

- Balance Sheet Total: EUR 20,000,000

- Net Turnover: EUR 40,000,000

- Own Funds: EUR 2,000,000

How we do it

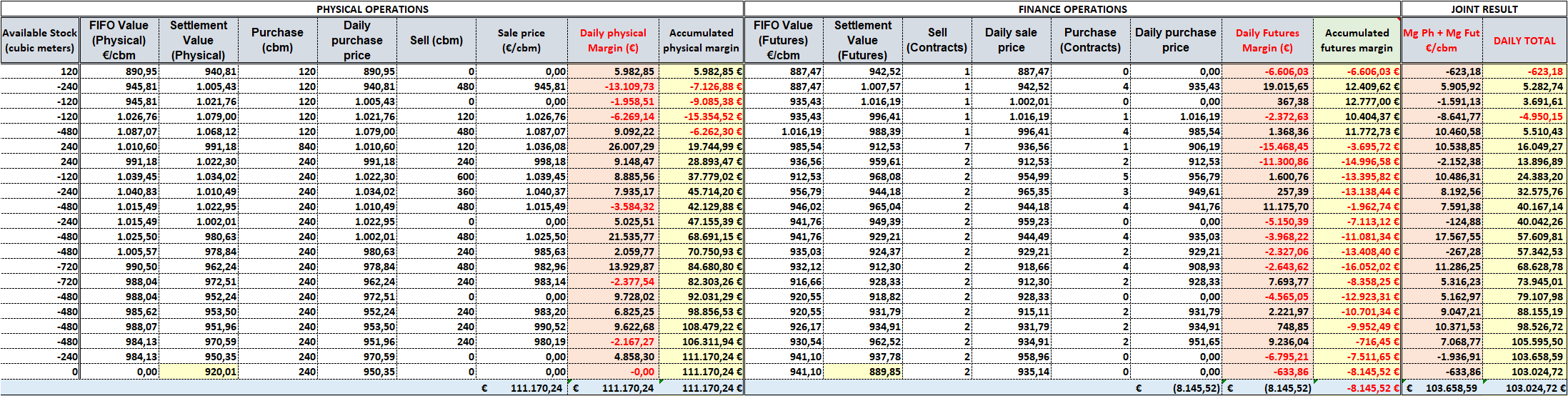

We have our own, proprietary and exclusive method, with tailored files and formulas, developed over years and years of hard work and deepening in every aspect of both the physical market and operations, and the derivatives part of the business, in collaboration with professionals from different branches. This wide scope tool allows us to have a clear and detailed outlook of every single operation down to the last cent.

We work hand in hand both with our customer and with the broker, in order to give our client a global view that reflects the results of the whole operation, from the physical and the financial side of the business.

Our method, tested for years with dozens of clients, ensures the desired results.

Financial Derivatives

These are financial products (Futures, Options, Swaps,) that allow the value of an asset (equities, interest rates, fixed income, commodities…), in real-time, with the aim of optimizing the management of the underlying asset, by protecting it from the volatility and uncertainty of the markets, and allowing to take advantage of opportunities both in the sale and in the purchase, that generate Competitive advantages that can be used to increase margins and/or volumes. On their own, they would be a speculative tool. Together with an underlying asset (diesel) they are essential to hedges.

All operations take place in organized markets (ICE, CME, etc.). They bear daily margin rates for each open position (exposure), as well as the yield of every position, both open and closed. Every operation is subject to execution, exchange and settlement commissions.

Benefits

By working in real-time, financial derivatives make it possible to identify opportunities to reach the market immediately through trigger trading. In this way, a price decrease can be immediately passed on to the market, allowing access to a sale without reducing the margin of the operation or even increasing it if it is not necessary to cede the entire price decrease to the market.

It allows in choosing the selling strategy each day by anticipating the amount to be sold daily by making trades at TAS (Trade at Settlement / at the closing value).

It allows in identifying incremental buying opportunities at times when you can lock in an arbitrage and move the advantage to another time.

This is a risk-free, real-time method that allows the pricing of purchase triggers without intermediaries, therefore applying the real variation of the market price without surcharges.

Objectives

Our main objective is that trading departments of different commodities can obtain a higher margin in their executions and minimize risks.

Due to the financial products that the markets offer (futures, swaps, options) we can hedge these purchases- sales (hedging) by locking in margins and reducing exposure to a fixed price which otherwise would be speculating.

In the same way, we advise with fundamental and technical analysis (based on Reuters/Bloomberg and reports) to help decision-making in both the short and long term with prices-trends, logistics, qualities(grades), legislation, inspections and financial analysis.

We train potential trading desks to be independent and function on their own.